how to calculate stock up rate

After those are filled in you divide. If we received 10 customer orders and.

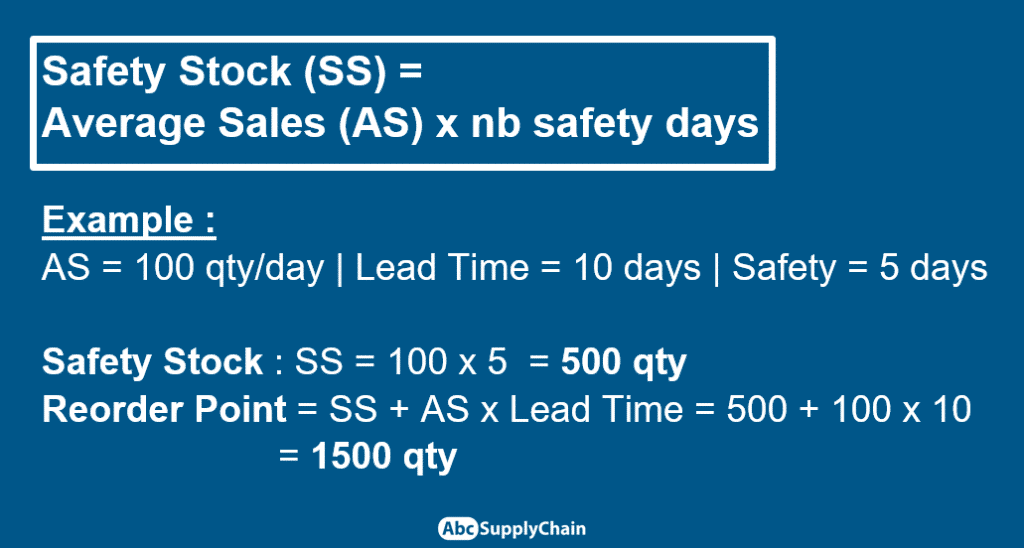

6 Best Safety Stock Formulas On Excel Abcsupplychain

P0 1rt FVt.

. Generally the rate of return is the compound return that results in the future value of the investment. Total returns for a stock result from capital gains and dividends. The cost of sales can replace the.

You can select the time units you wish to use for. How is share price calculated with example. This free online Stock Growth Rate Calculator will calculate the percentage growth of a companys earnings per share over time.

Three or more percent. 2465 divided by 14839 166 times the current PE ratio. What makes up the rate of return on an investment.

Lets suppose Heromotos PE ratio has been 1853 in the past. It would be calculated as follows. In other words we can stay that the Stock Price is calculated as Lets.

Just follow the 5 easy steps below. Enter the number of shares purchased. A rate of return RoR is the net gain or loss on an investment over a specified time period expressed as a percentage of.

The equation that the Gordon Growth. Total costs include the initial. The Stock Calculator is very simple to use.

Stock Turnover Ratio Formula Cost of Goods Sold Average Inventory Where The cost of goods sold equals Opening stock Purchases Less Closing Stock. 083 growth rate or about 8. 15 1 10 10 x 100 60 Example Rate of Return Calculation Adam is a retail investor and decides to purchase 10 shares of.

The present value of stock is equal to dividend per share divided by the discount rate from which the growth rate has been subtracted. An order fill rate works the same way - all units on all lines of the order must be 100 in-stock in order for the order to count as in-stock. To calculate net returns total returns and total costs must be considered.

Enter the purchase price per share the selling price per share. 50 by simply 66 to obtain a 0. All a person need to estimate a basic progress rate are two numbers 1 that.

Stock Price 1 rate of returnt Future Value. We can calculate the stock price by simply dividing the market cap by the number of shares outstanding. The fees charged to facilitate trade is called brokerage.

You would need to know how many items in the store and how many outages there are and also if any items of an empty spot are in the back room. Within this example divide 5. The calculator helps us accurately decipher these fees separating individual heads like STT GST duty charge transaction fees.

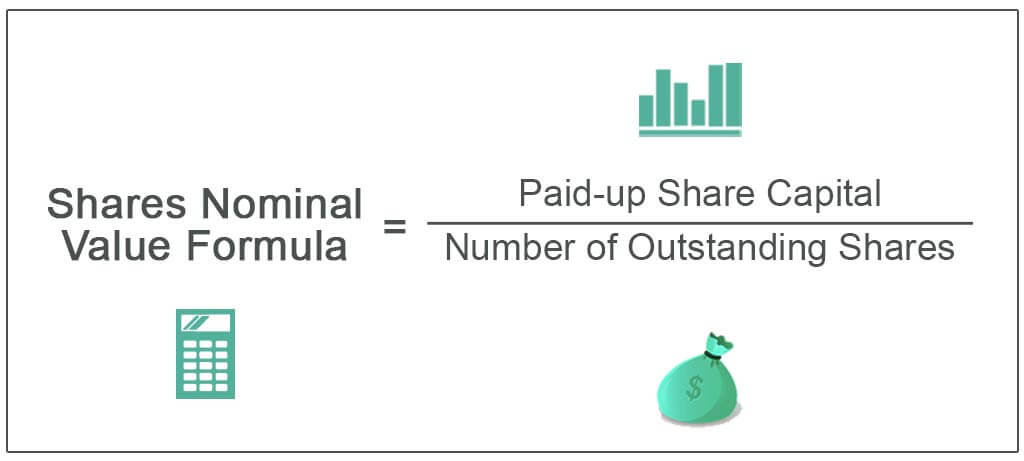

Nominal Value Of Shares Meaning Formula How To Calculate

What Is A Stock Up Price The Krazy Coupon Lady

:max_bytes(150000):strip_icc()/Investopedia_Returnoninvestmentformula_colorv1-6d281839c5814e109e316ebbbb61a5bd.png)

How To Calculate Return On Investment Roi

How To Calculate Percentage Increase Of A Stock Value

How To Predict If A Stock Will Go Up Or Down Beginners Guide Getmoneyrich

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Enterprise Value Importance Formula And How To Calculate It The Motley Fool

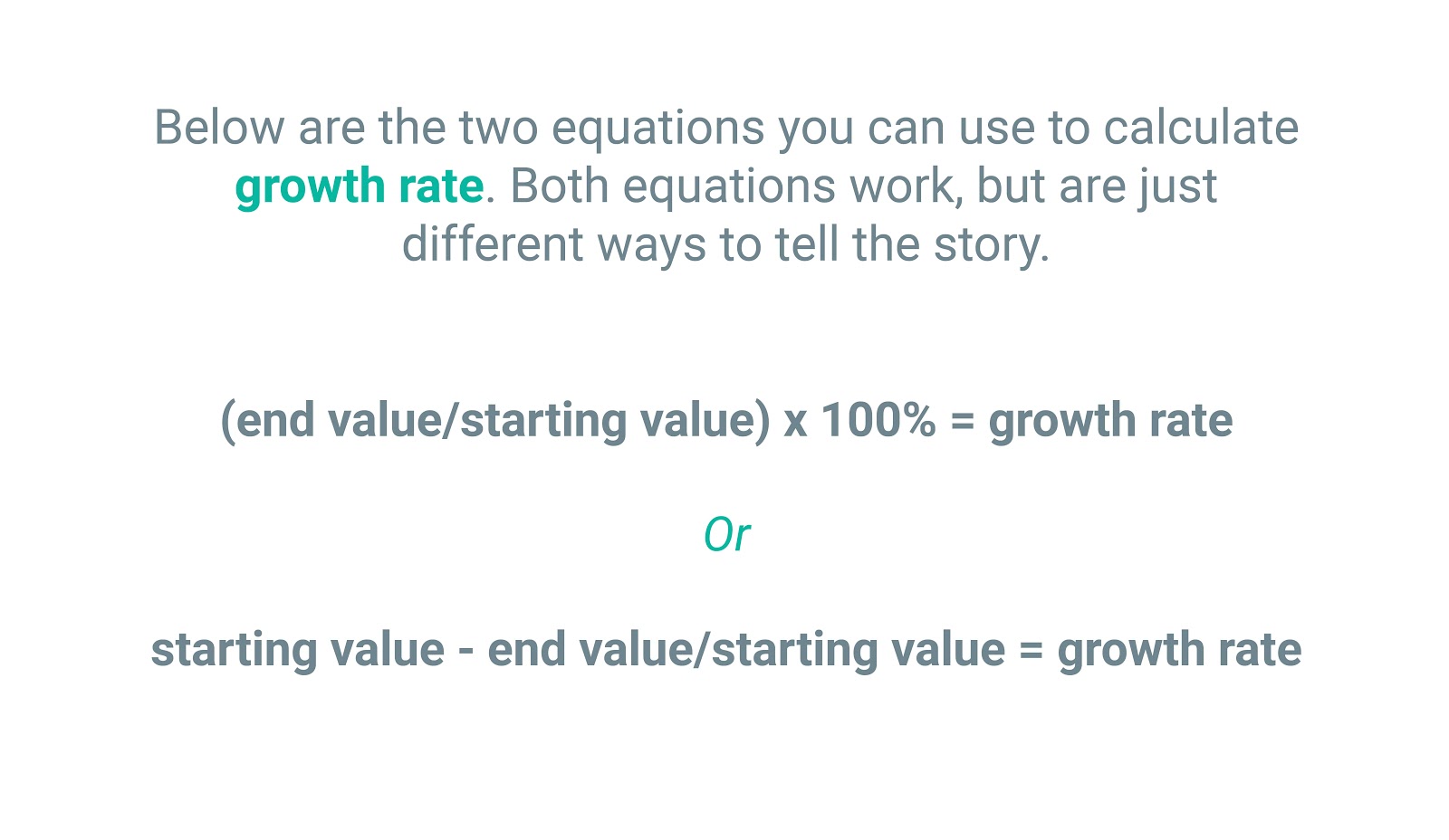

How To Calculate Business Growth Rate Formula

Common Stock Formula Calculator Examples With Excel Template

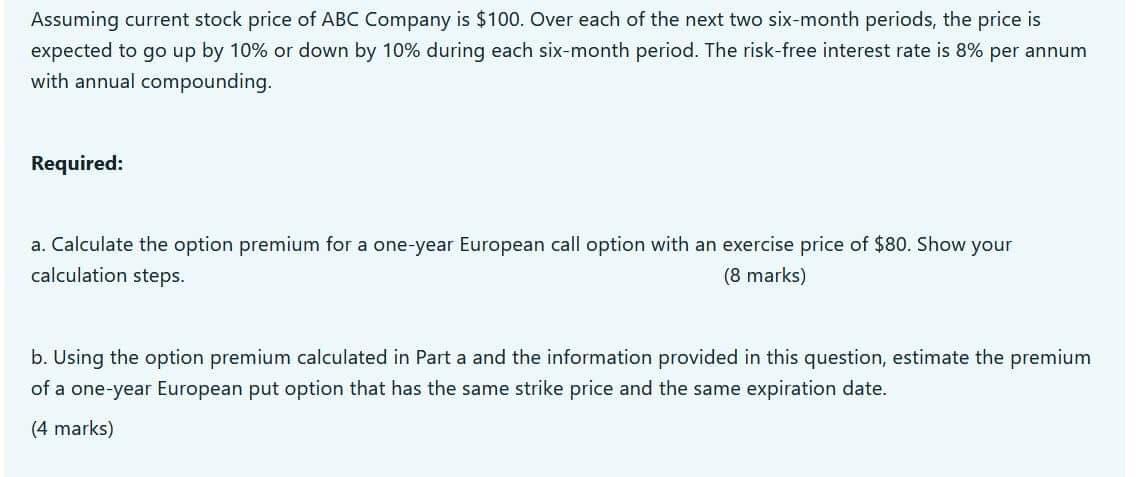

Solved Assuming Current Stock Price Of Abc Company Is 100 Chegg Com

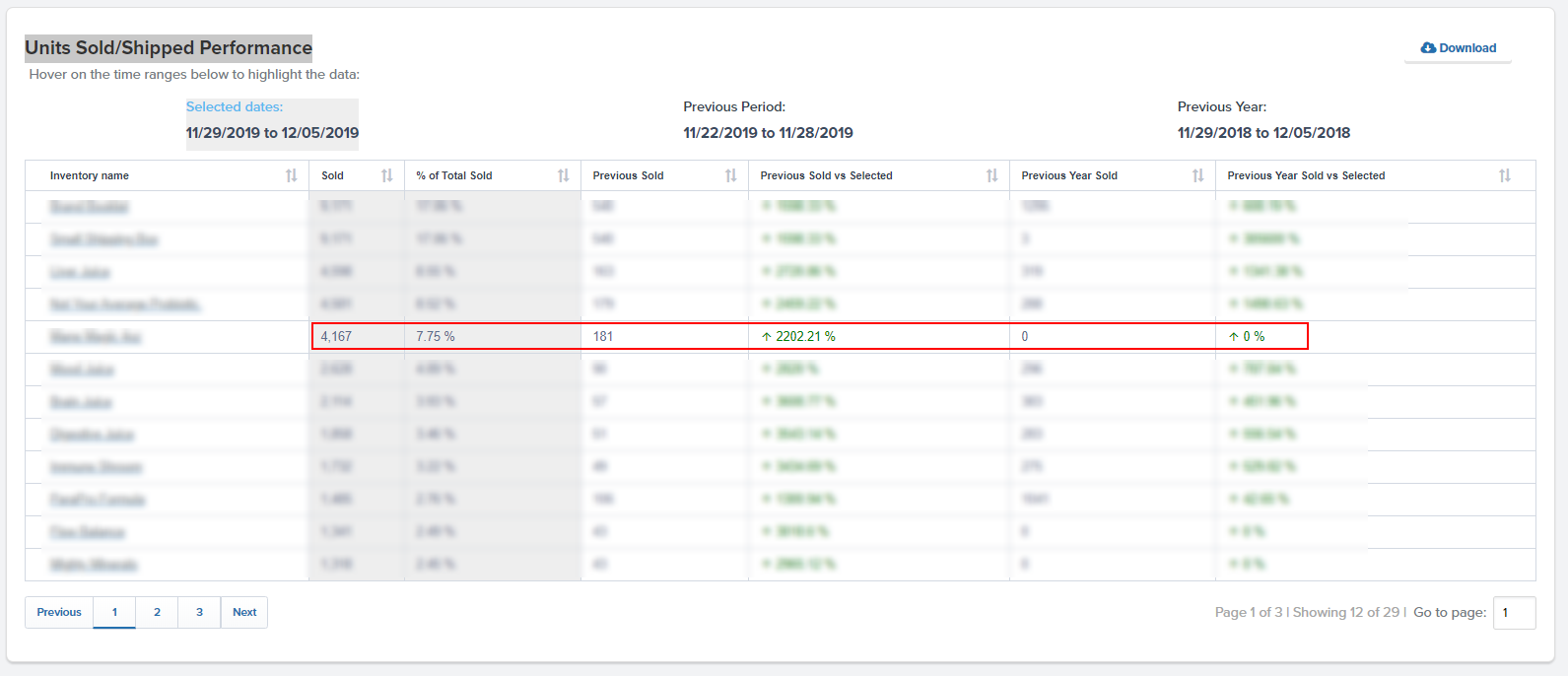

Optimal Inventory Levels Calculate Manage Your Stock Levels

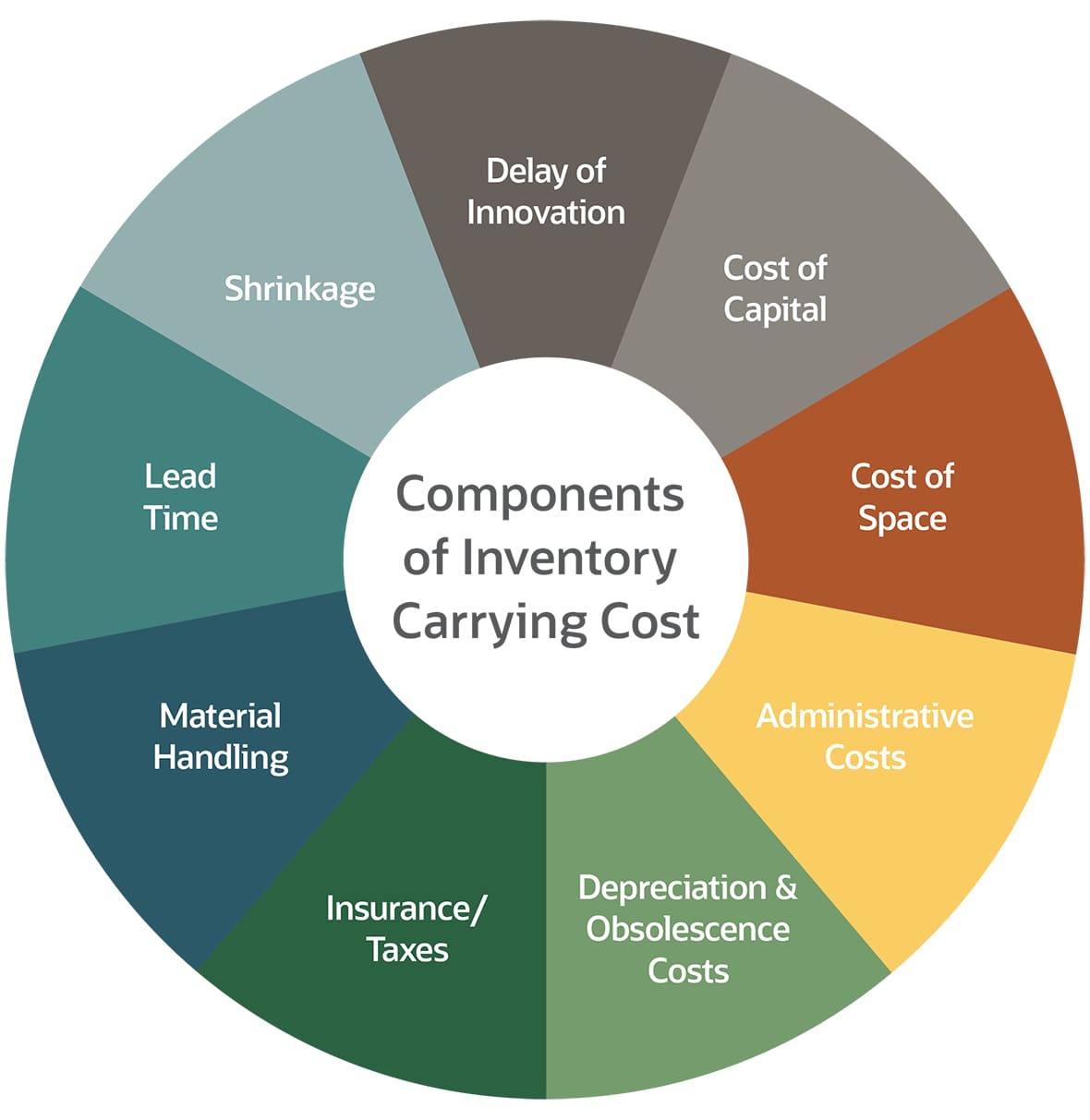

Inventory Carrying Costs What It Is How To Calculate It Netsuite

How To Calculate Food Cost Formulas For Chefs And F B Managers Apicbase

Wacc Formula Definition And Uses Guide To Cost Of Capital

How To Calculate Annualized Portfolio Return 10 Steps

Solved Consider A Two Period Binomial Model In Which A Stock Currently Trades At A Price Of 65 The Stock Price Can Go Up 20 Percent Or Down 17 Pe Course Hero

How To Calculate The Daily Return Of A Stock Finding And Interpreting Results

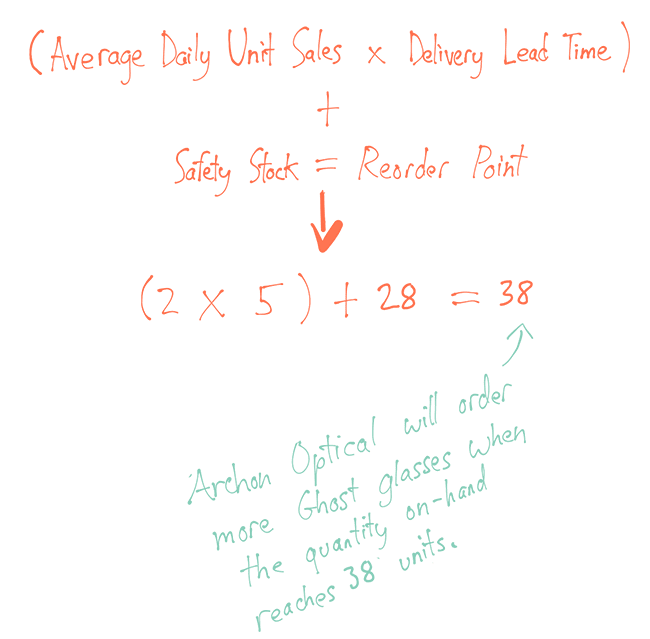

Reorder Point Formula And Safety Stock A Complete Guide

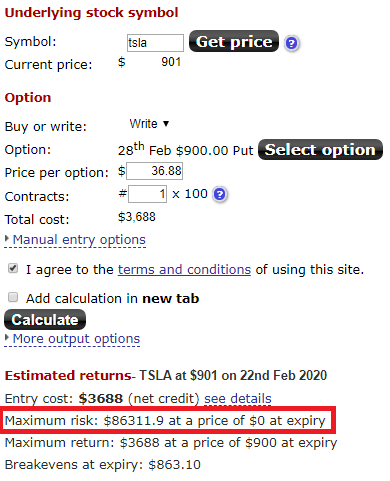

4 Popular Theta Gang Strategies To Collect Premium From Options